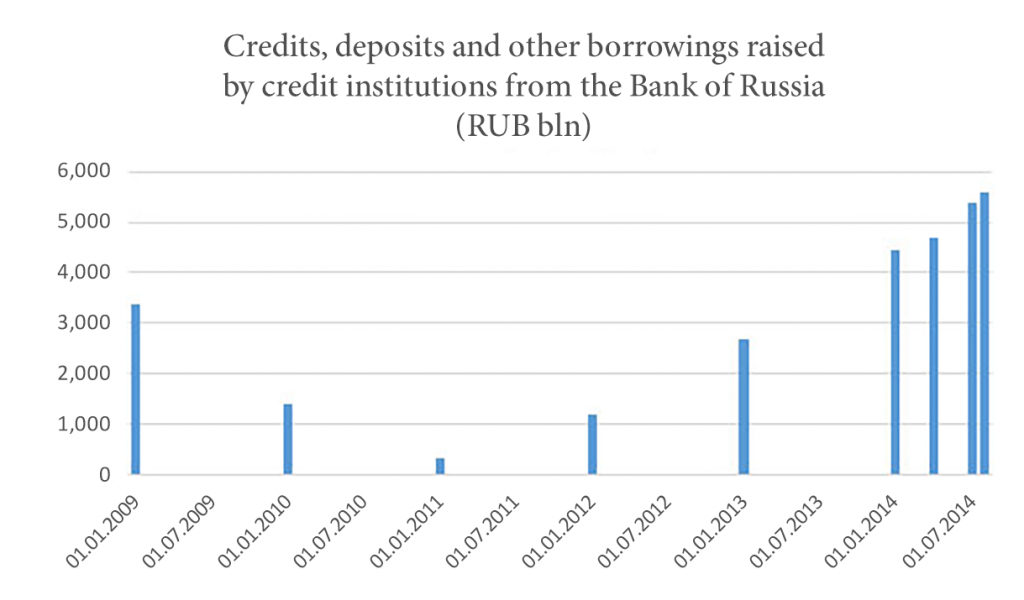

CENTRAL BANK’S MONEY ACCOUNTING FOR 10% OF THE BANKS’ LIABILITIES

The Central Bank of Russia’s greater lending to the bank sector in recent years attracted many experts’ attention: some of them point to convenience and efficiency of transactions on the public market; others apprehend that the quality of security under these transactions will deteriorate and credit institutions’ reliance on the Central Bank will increase.

Source: Bank of Russia

For instance, Fitch Ratings global rating agency regards it as a threat that “the Central Bank undertakes all the economic risks and banks restrict the range of potential borrowers”.

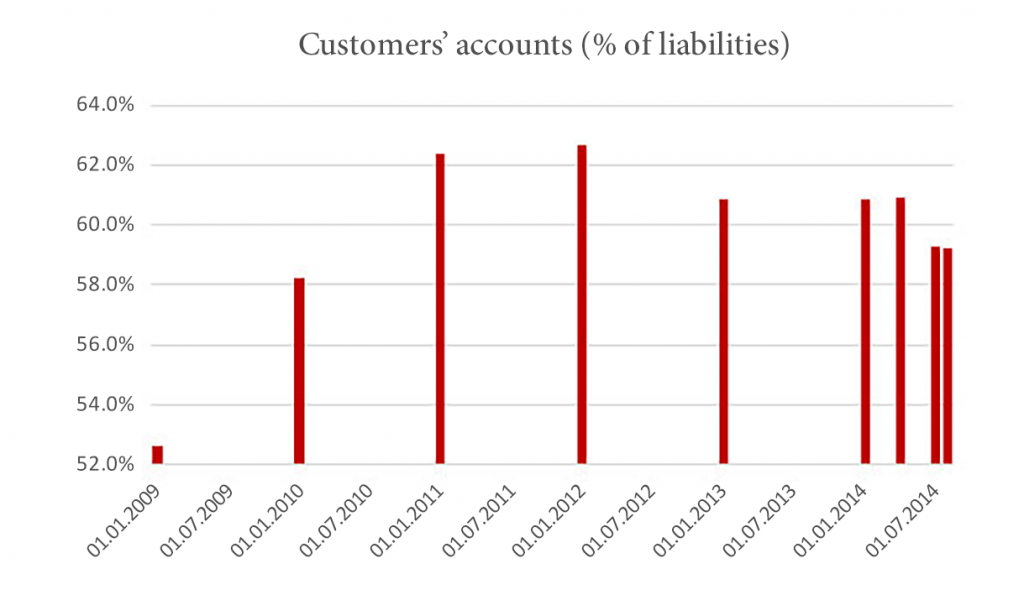

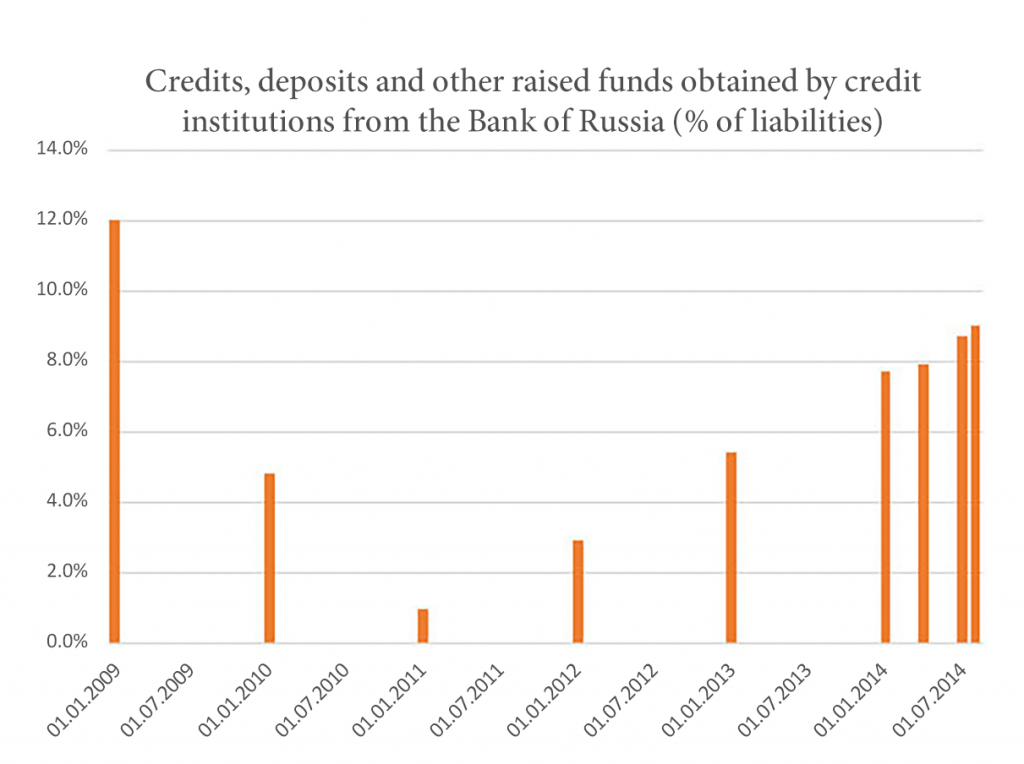

The Central Bank’s lending to the bank system itself does not seem to trigger concern. Let’s recall that support to the stable operation of the banking system is among the Bank of Russia’s objectives, and consequently, any steps aimed at fulfillment of this objective seem quite justified. At the same time, the growing pool of money the Bank of Russia provides to credit institutions arouses the experts’ concern. The resulting reduction in the share of deposits in banks’ liabilities, caused by a series of external and internal adverse factors, restrains bank lending to the real economy.

Source: Bank of Russia

Obviously, in this environment the Central Bank is consciously using the tools to regulate liquidity in the banking sector, thus expanding the applicability of the public market transactions; after all, the “successful” examples of large-scale funding of lending agencies were quite numerous in recent years.

Source: Bank of Russia

However, it should be understood that the efforts taken produce short-term impact on financial market only and are not conducive to economic growth. The Bank of Russia has recently functioned as the lender of last resort (which, undoubtedly, supports the market and averts larger-scale crisis developments), focusing on achieving the inflation target. However, the Central Bank’s backup discourages the banks from supporting the financial services market at a level that may drive the real economic growth.

However, if strategic goals and the corresponding objectives are not revised, the state of the Russian financial system will depend on how efficiently the Central Bank will respond to the existing market trends.

News

-

It’s All Set for a Radical Transition to the CryptoRuble

The article by A.Vavilov "It’s All Set for a Radical Transition to the CryptoRuble"/“Vedomosti” new...

-

Credit-driven Asset Inflation and Intergenerational Wealth Transfers by G. Trofimov

"Credit-driven Asset Inflation and Intergenerational Wealth Transfers" article was published in Journal of Mac...

-

FINANCIAL MARKETS’ DIFFICULT PUZZLES

The article by G.Yu. Trofimov, IFI Chief Economist, Financial Markets’ Difficult Puzzles, devoted to the Noble Prize Win...

-

A. Vavilov became a member of the New Economic School Board of Directors.

In May 2013 Andrey Vavilov became a member of the New Economic School Board of Directors.

-

Europe-Asia Studies reviewed Andrey Vavilov's "The Russian Public Debt and Financial Meltdowns"

Europe-Asia Studies reviewed Andrey Vavilov's "The Russian Public Debt and Financial Meltdowns" in Vol. 65...

Analytics

-

Competitive storage and commodity price in continuous time

Commodity Markets \ pdf, 602.5 Кб

-

SOLLERS and FIAT versus GAZ GROUP, DUCATO versus GAZEL

Industrial \ pdf, 284.23 Кб

-

AVTOVAZ stakes on LADA priora

Industrial \ pdf, 270.01 Кб